This is an in-depth guide on how to generate a steady and consistent flow of qualified sales leads for financial products and services, using digital marketing and marketing automation strategies.

Who is this guide for?

This guide is aimed at the owners, directors and marketing managers of financial services firms – or in fact anyone with a vested interest in attracting customers and clients in the financial services industry.

- Mortgage brokers

- Commercial finance brokers

- Financial planners

- Funds managers

- Super/SMSF specialists

- Insurance

- Short term loan brokers

- Investment specialists

- Payment systems

Financial services is one of the largest sectors in the global economy, making up 7.5% of commercial services.

But where there is money, there is also competition. And competition for customers in financial services is intense.

You might say that the ability to create customers is the critical competency that either constrains or powers the growth of your firm.

This Guide shares some of the most important things we’ve learnt about creating customers in the financial services industry over the last 11+ years.

Everything you’ll read below is based on experience, testing and results working in the industry and seeing what works.

Now let’s explore some of the challenges faced by marketers of financial services today, before looking at potential solutions…

The Top 6 Challenges Faced By Marketers Of Financial Products And Services

Most of the challenges faced by marketers of financial services are by-products of the fact that in this sector we’re likely to see some or all of the following features:

- high transaction size

- high customer lifetime value

- high profit

- high leverage (time leverage and money leverage)

- large potential market size

These features promote competition for customers, which is at the root of most of the marketing challenges you’re facing.

Specifically, here are 6 problems that are relatively common among financial services firms:

Challenge #1: Qualified lead generation

It may seem redundant to list “lead generation” as a challenge in a report all about how to generate leads.

But what I mean by this is that most financial services professionals are actually pretty good at selling. What they lack is enough qualified people to sell to.

Here’s a question I often ask potential clients:

If I get 10 qualified buyers and sit them down in front of you for a meeting, how many would you convert into a client on average?

Most people answer between 7 and 10!

So selling usually isn’t the problem. The problem is a lack of qualified prospects to sell to.

Challenge #2: Explaining complexity

The next challenge is explaining complexity. To most “average” consumers, financial products are something of a mystery.

Distinctions that may be obvious to you, may be “clear as mud” to your potential client.

Examples:

- The benefits of using a home loan offset account for interest reduction

- The pros and cons of investing in property inside super vs outside super

- The importance of household cash flow management and using free cash to build investable assets

- The value of “Product A” over “Product B”, or “Approach A” vs “Approach B”

For your marketing to succeed, you must make the complex simple – no easy feat!

Challenge #3: Effectively differentiating your offering

Another problem is that more often than not, the customer has “heard it all before”.

So they filter out your marketing message, and as a result, they fail to understand how you’re different and what that means to them.

(Or maybe, you’re not really different in the first place. This is a big red flag. Our experience shows that meaningful differentiation is THE cornerstone of profitable marketing campaigns, online or offline – and I go into how to achieve that later in this article)

Take one segment of the financial services industry – mortgage broking.

The “standard marketing message” in this industry can be paraphrased something like this:

Don’t go to a bank or lender who will push only their products at you. Come to us and our brokers will compare 32 banks and lenders to get you the right loan for your situation, while doing all the legwork for you. Plus our service is FREE to you, the borrower.

The fact that there is a “standard narrative” in this category suggests that the market is saturated with vanilla, non-differentiated messages.

Other categories have their own standard narrative, too.

Simply reciting the same message as everyone else won’t get traction and will usually make achieving a strong return on your marketing impossible, because of the next problem…

Challenge #4: The high cost of attention

Again, because financial services is a large, lucrative category, advertisers are prepared to pay handsomely to attract eyeballs.

This drives up the cost of media.

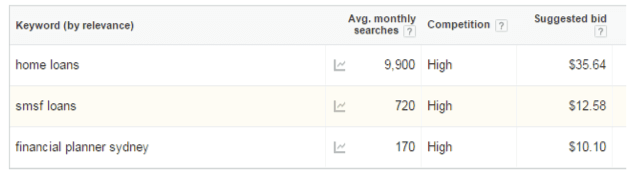

Perhaps the best barometer of this is Cost Per Click (CPC), where advertisers pay for clicks according to a type of auction system.

Let’s look at the estimated cost per click for a few common terms:

..and for the purposes of this exercise, let’s take these estimates at face value.

$35.64 per click (i.e. per visit) is a lot of money to pay, unless your website converts at a high enough rate.

And it’s not just AdWords. Niche publications such as API Magazine, Your Investment Property Magazine, Smart Money and the Australian Financial Review etc. also have high rates – because advertisers will pay them.

The “free” side of Google offers no respite either. If the value of a visit is high, companies will pour resources into content marketing and Search Engine Optimisation in order to drive increased rankings and visits.

It’s an arms race. And your “cost per visitor” ends up rising as a result.

Bottom line – if you focus on traffic generation and don’t focus on conversion, you won’t win.

We recommend flipping the standard “traffic centric” approach upside down, and building the strongest CONVERSION system possible, with a strong Unique Value Proposition (more about this later) and a high-converting sales funnel (more about this later too).

Then, you can afford to pay the high cost of traffic while still making a profit!

Challenge #5: Long sales cycles

Taking into account a number of factors – the high degree of complexity, high transaction value, potentially multiple decision-makers, emotions of fear and greed and so on – it’s no surprise that customers can take their time to make a decision.

There’s a continuum here.

A mortgage broker specialising in “mum and dad” home purchases may find they have a relatively short sales cycle. The customer finds a home they want and they need a loan.

But a financial planner who sells long-term investment advice may encounter a very long sales cycle indeed, because of decision-making inertia: It’s easier to continue to doing nothing than to do something.

Where there is complexity there is always going to be longer sales cycle. However, there is a lot you can do to influence and compress your sales cycle.

Here’s an article that addresses this topic in much greater depth: 10 Ways To Shorten Your Sales Cycle From 10 Weeks to 10 Days [Case Study]

Challenge #6: Finding active growth strategies that work

With all of the above challenges, you’d be forgiven for wondering why financial services firms advertise at all! And yet they clearly do.

Many very big institutions get by on the back of “the flywheel effect”. They have a big enough customer base and they’ve been around long enough that they don’t have to excel at results-accountable marketing to stay in business.

Whereas many very small firms (for example, 1 or 2 principal mortgage brokers or financial planners) do almost no marketing – often because they haven’t figured out how to make it pay.

So they get most of their new clients through passive or non-scalable methods – for example, partner referrals, word of mouth or networking.

There’s nothing wrong with these methods per se, except that they typically won’t power significant growth. The value of cracking the marketing code is in creating a growth engine that allows you to grow client numbers, locations, team members, revenues and profits.

How Do Most Financial Services Firms Market Their Business?

Briefly, here are the main methods firms use to market themselves, with the typical results of each one. (These methods are a summary of our conversations with hundreds of financial service firm principals)

1. Partner referrals (e.g. referrals from allied professionals)

Don’t get me wrong, partner referrals are great. They typically position you as an expert and result in very high close rates.

The drawback is that partners typically refer when they want to refer… not when you need clients.

So this is a great method, but non-scalable.

2. Client Referrals

The same pros and cons apply to customer referrals.

Typically, customers won’t position you quite as well as an allied professional, but an endorsement from an existing client is a fantastic door opener in most cases.

So again, generate all the customer referrals you can, but if you find you still have a growth deficit, active growth strategies will be required.

3. Networking

Aahh… the fine art of networking.

Some people excel at it and enjoy it. Others do not.

If networking is your thing, great! Keep it up. However, if you’re one of those people who cringes when they hear the word “networking”, my observation is that it’s never going to work really well for you.

Networking training can help, but typically won’t transform you into a networking superstar.

4. Speaking and Events

Speaking and events can be very effective methods of client acquisition.

The challenge is always how to fill the room. If someone else does it for you, then nine-tenths of the battle is won.

If you have to do it yourself, then you’ve still got a marketing challenge on your hands.

My view is that in Australia at least, public events have had their day. They are typically very expensive to fill, and have a host of logistical challenges.

A few companies specialise in this format and may appear to do well – but the blood, sweat and tears behind the scenes is often extraordinary.

We’ve typically found that it’s actually cheaper to drive a 1-on-1 appointment booking, than it is to drive that same prospect to book to attend an event.

One event format that does work well, is to run smaller-group “client only” events on a topic of interest. Getting a few dozen clients in a room for wine and cheese and a presentation can work very well, depending on the economics of what you’re selling.

5. Mass media – TV and radio

A few – not many – of the financial services clients we’ve worked with have had the right offering and the right marketing to make mass media work.

The big problem with mass media is the near-certainty of “over covering” – paying to advertise to people who could never buy from you.

Mass media can work IF you have a broad-appeal product, with the ability to somewhat target your audience.

For example, we’ve seen budgeting solutions and payday loans work on radio.

We’ve also seen investment property investment pitches work in mining towns during the mining boom (note the broad appeal to that target market).

So it can work, but our advice is to test and refine your message online first, before testing mass media.

6. Telemarketing

Appointment-setting via telemarketing is another method that is both a blessing and a curse.

It can be a blessing because it can work… and when it does, you can scale very easily by just going broader in terms of geography and by adding people on the phones.

But it’s a curse because I’ve seen more than a few companies get very addicted to and over- reliant on telemarketing leads.

And what tends to happen is that the cost of appointments goes up and up incrementally to the point where it’s no longer profitable – by which time you have a large organisation built around a flow of inbound appointments.

The other thing that happens is that telemarketing campaigns tend to go well for a time, then suddenly fall off a cliff. So in a matter of a few weeks, performance can suddenly drop. That is also very disruptive.

The final spanner in the telemarketing works is the Do Not Call list. Over two thirds of Australian residences and 4.3 million mobile phone numbers have been added to this list, which shrinks the pool of consumers whom you can reach in this way.

And as that pool shrinks, the rest of the people still eligible to be called end up getting smashed by more unsolicited calls, which drives more people to add their name to the DNC list.

You can see the problem here… telemarketing in general seems to be a promotional vehicle in decline.

However, if you’re using this and it’s working, by all means keep doing it – but be careful of putting all your eggs in one basket.

7. Print media

Print media still works – especially niche print media.

In order to advertise in mass print media (e.g. newspapers), you need a broad appeal offer and a high allowable cost of acquisition (i.e. the amount you can afford to pay in order to profitably acquire a customer).

If it works, great!

But as always, test small, test and measure, then expand what works.

8. Online marketing

Then there’s online marketing.

Online marketing has some extremely attractive features:

- It’s highly measurable and accountable, which means if you do it right, you can scale what’s working and cut what isn’t working quickly.

- It’s on the right side of the trend in that more and more customers are doing extensive research online prior to making any sort of purchase decision (see next section).

- And online is more of a level playing field than most other media. There’s no reason why small or niche players can’t do very well if they take the right approach, even against much bigger and deeper-pocketed competitors.

That being said, you still face the problem of intense competition and an ever-increasing array of complexity around tools and tactics in the digital marketing space.

I’ve spoken to many firm principals and executives who have an extensive presence online… and I’ve also spoken with more than a few owners or executives of financial services firms who have “put their toe in the water” a few times with online marketing and have got burnt… or who are ticking along at a relatively low level, without feeling like they’ve really cracked the online code.

We’ll devote most of the rest of this report to successfully navigating the online space to drive leads and clients in the financial services sector.

And the reason for our focus on online is because of the rise of the “Zero Moment of Truth”, and what that means to the future of your business growth…

The “Zero Moment of Truth”

Why growth-oriented financial services firms must master the online landscape

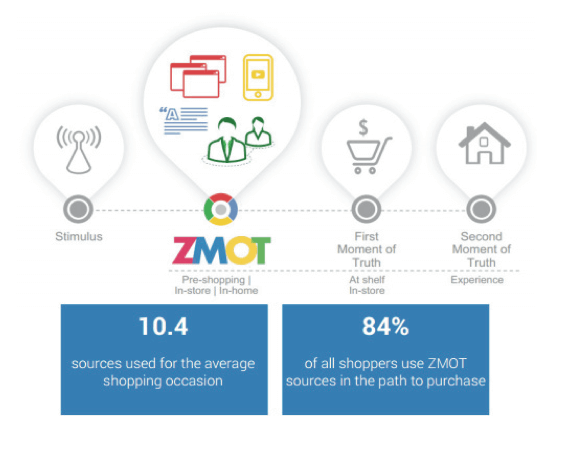

The Zero Moment of Truth or ZMOT is a term coined by Google to describe the new reality of how consumers buy.

The “Zero Moment” occurs when buyers have a need, intent or question they want answered online. It’s at this moment, before the buyer has even left their home or thought about solutions, that financial services marketers have the opportunity to start the selling process and move the prospect toward making a buying decision.

We conducted our own independent research on this.

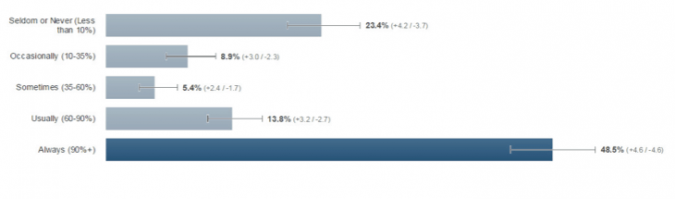

While it’s not specific to financial services purchasing behaviour in particular, I believe it is instructive. We asked 500 survey respondents between the ages of 25 and 54 the following question:

When you buy anything worth at least $500, how often do you conduct pre-purchase research online?

And here are the results:

That’s right: almost half of the surveyed individuals always conduct pre-purchase research online for high- value items. And the trend is building.

How many of your prospects and customers are researching online before they buy? A lot, I bet.

If you accept that there are many potential customers and clients searching online right now for what you offer, then the next question becomes…

Characteristics of Super-Successful Online Marketing Campaigns In Financial Services

Put simply, the most successful online marketing programs are ones that are able to overcome the marketing challenges we explored earlier.

In short, they achieve the following goals:

- They effectively differentiate your offering

- They distill complex messages and make them simple

- They are engineered for conversion (so you can afford to generate traffic en masse)

- They are designed to compress long sales cycles and drive faster decision making

Business uber-guru Peter Drucker said:

The purpose of marketing is to make selling unnecessary

And that’s what an effective web strategy does – it harnesses the power of marketing to drive highly qualified leads that make brute-force selling unnecessary.

OK, you now know WHAT you need to achieve. Now let’s look at exactly HOW to achieve it using the strategies and methods we’ve developed over the last 11+ years…

Exactly How to Achieve What You Need to With Online Marketing

PILLAR 1: Define and articulate a killer Unique Value Proposition

It’s almost become a cliché – “you need a unique point of difference”.

The truth is even worse. You need MORE than just a unique point of difference. Now a Unique Value Proposition (or UVP) is just the “price of entry”.

Meaning, if you DON’T have one, or it’s unclear to your target market, you’re toast.

Because the purpose of a UVP is to tilt the playing field in your favour, so you can spend less on traffic to get better results than your competitors.

Everyone knows you need a UVP. Many purport to have one. But relatively few UVPs are actually effective. By effective, I mean that demonstrably and measurably:

- get attention

- cut through the clutter

- attract ideal customers

- repel customers you don’t want

- increase advertising effectiveness

- drive lower cost per lead, etc.

Marketing Results has a whole methodology for developing Unique Value Propositions that work, so I won’t reprint it here.

To read more about this, you’ll find a very comprehensive, free article here: How To Create An Effective Unique Value Proposition

Types of UVPs that work in financial services

It would be “speaking out of school” to divulge too much about specifically what has worked for specific clients, but I will tell you what kinds of UVPs tend to work in the financial services sector.

- Focusing on a specific type of target customer

e.g. retirees, students, Centrelink benefit recipients, specific professionals, residents of specific countries etc. Appeals to being a “local area expert” may work, however suggest this for regional firms rather than city firms with a high population density (for an example of a firm doing this well, refer to Aussiewide mortgage broking in Geelong, Victoria). - Focusing on expertise in a specific product category

e.g. first home buyers, investors, SMSFs, geared equities, payday loans, bad credit loans etc.

Generally, if you’re NOT focused around either of these two concepts, then you run the risk of entering the mass market, where you’re competing against some of the largest institutions in the country, with some of the deepest pockets.

If you take one thing out of this Special Report, make it this. You need a compelling UVP to “anchor” your marketing around a defined space in which you can win!

It’s better to have 80% of 1% of the market than 0.0001% of 100% of the market.

PILLAR 2: A marketing funnel capable of converting a raw visitor into a qualified, ready-to-buy prospect

A strong UVP is the marketing “ballast” that will form the core of your marketing message.

The next pillar of your successful online marketing system is an effective marketing funnel for converting raw visitors into qualified, ready-to-buy prospects.

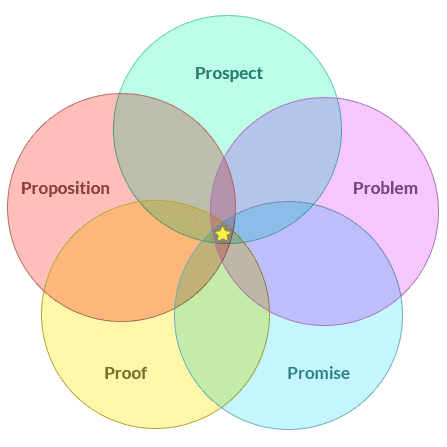

We’ve developed a special methodology for designing marketing funnels called the Sales Lead Machine Blueprint.

Here’s what it looks like:

Again, in this article I’d prefer to focus on what specific elements of the Sales Lead Machine Blueprint are particularly effective for marketers of financial services – but to get a grounding in the overall methodology, I’ve put together a free video course, which you can access here: Double Your Leads in 30 Days [Free Video Course]

Sales funnel elements that work in financial services

(*** Recommendation: this section may make more sense after you’ve watched the videos above, especially if you’re not familiar with multi-step conversion processes **)

We’ve already talked about financial services being complex and harder to differentiate than some other categories.

So what definitely WON’T work, is if you create a website with a bullet point list of the different services you provide, plus an “enquire now” form.

There just aren’t enough reasons to respond.

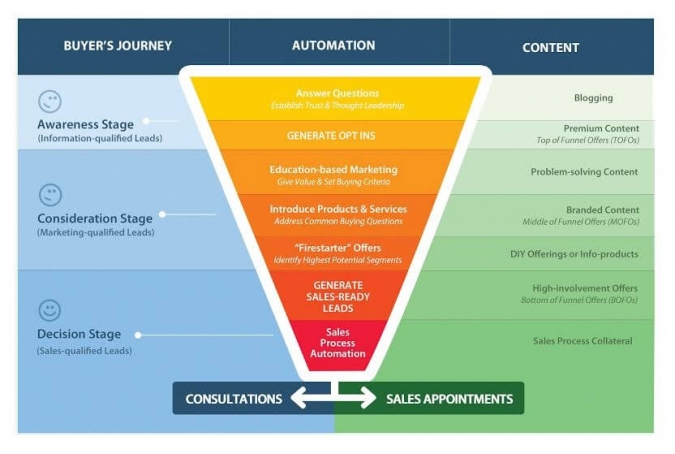

So the alternative is to put together an education-based marketing approach using the Sales Lead Machine Blueprint.

This usually has a lot of moving parts, but the main three phases are:

Phase #1: Offer A Quick Educational Resource

This is known as a Top of Funnel Offer (TOFO).

Typically you would offer a resource that the user can gain access to by entering their email address.

For example:

- A Special Report or White Paper

- A Success Story or book of Case Studies

- A Video

The purpose of this resource is to build trust and educate the prospect on the value of your solution.

This is one of the ways you reduce complexity and get the prospect to a point where they can move forward faster with a decision.

Phase #2: A Deep Educational Resource

This is called a Middle of Funnel Offer (MOFO).

The purpose is to deepen your conversation with the prospect, while still not “spooking” them with a direct 1-on-1 sales consultation.

And a typical approach here would be to offer a webinar – perhaps 60 or 90 minutes long – where you explore concepts in more depth.

Again, the purpose is to build trust and answer common questions in the marketing stage. Remember what Drucker said: “The purpose of marketing is to make selling unnecessary”.

You can use what’s called an “Evergreen Webinar” strategy to replay the same webinar every week (or as often as you like) in order to ensure prospects can access this information exactly when the timing is right for them.

Phase #3: A 1-on-1 Consultation Offer

This is called a Bottom of Funnel Offer (BOFO).

And this is where you propose to the prospect a 1-on-1 Consultation (or similar).

The purpose of the consultation is to discuss their situation and whether or not your solution is right for them, and if so, how it would work.

Again, the value of Phases 1 and 2 is that they set you up for a great conversation in Phase 3.

If you try to get prospects straight to Phase 3, you’ll typically be met with resistance (though not always. If urgency is very high e.g. for a payday loan, then you might go straight to this stage).

To recap: Pillar 1 is a Iron-clad Unique Value Proposition. Pillar 2 is a tight marketing funnel. Now you’re ready for Pillar 3…

Pillar 3: Effective traffic generation campaigns

At the risk of labouring the point – profitable, sustainable and scalable traffic generation is only possible in financial services if you get the first two pillars right!

If you’re lax on the first 2 pillars, then as sure as night follows day, traffic will be unsustainable and unprofitable.

So let’s assume you’ve locked in the first two pillars. Now let’s cut to the chase and talk about what traffic methods tend to work the best in financial services:

First, let’s talk about what tends NOT to work:

The “friends and fans” side of social media (as opposed to the advertising side) tends NOT to work as a customer acquisition vehicle.

I’m sure there are exceptions, but that’s our experience.

The methods below can potentially drive hundreds of new clients a month (depending on your industry). It’s nigh on impossible to do that with Twitter, Instagram and Facebook pages.

Now we have that out of the way, let’s talk about what DOES work.

Traffic Method #1: Google AdWords

No doubt about it. Google AdWords works for financial services. But, it’s also pricey (hence my rant about conversion above).

Google AdWords isn’t cheap, but it can be cost-effective.

And there’s no doubt that it has the potential to drive new customers in large volumes.

If you’re interested in learning more about specific optimisation approaches with Google AdWords, then subscribe to our free video series here: Double Your Leads in 30 Days [Free Video Course]

In the third video in the series, I discuss traffic generation strategies in depth.

Traffic Method #2: Facebook Advertising

Notice I said Facebook advertising. I’m not talking about the friends-and-fans side of Facebook here. Especially if you’re marketing B2C, we’re finding this method very effective at the moment.

On average, Cost Per Click is about one-fifth that of AdWords. Conversion rate from lead to sale tends to be lower than AdWords. But the lower CPC makes it worth it.

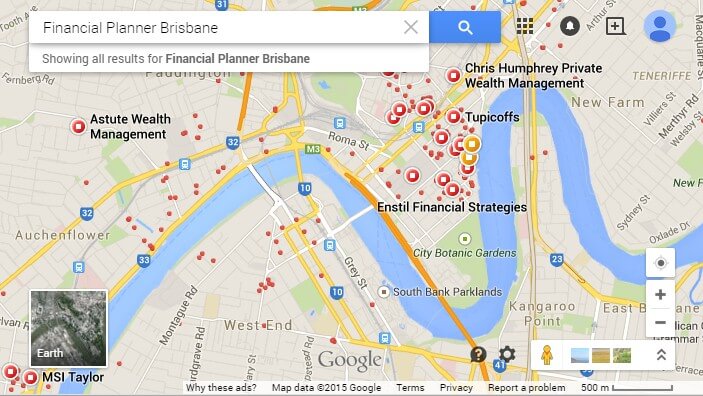

Traffic Method #3: Google maps listings (local marketers only)

If you operate within defined geographical areas, then you may find that it is quicker and easier to get traffic for targeted searches via Google maps listings, as opposed to “regular” organic rankings.

At least for the time being, “city pair” search terms such as Financial Planner Brisbane or Mortgage Broker Perth are usually less competitive within the “maps” area of Google than in the normal organic listings.

The cost/benefit of this type of optimisation is often more attractive than that of organic inbound marketing or Search Engine Optimisation activity.

Traffic Method #4: Organic Google Traffic

That being said, there’s no doubt that Google has the power to drive high volumes of targeted visitors via their organic listings.

Again, rather than cover specific strategies again in this paper, my free traffic video unpacks a high-level strategy for achieving lasting success on Google: Double Your Leads in 30 Days [Free Video Course]

Just remember not to refer to organic Google traffic as “free” Google traffic – it’s anything but free! Achieving solid rankings, especially in a competitive industry such as this one, requires an investment of either time or money.

It’s not free, but it can be cost-effective.

Implementation Approaches

In this guide, we’ve explored the online marketing landscape around financial services.

And I’ve shared with you some of the key learnings from the last 11+ years generating leads in this space.

I’ve shown you what’s worked for us and I invite you to test these concepts for yourself.

The next question to consider is, how do you implement these strategies?

And there are 4 broad approaches:

Option 1: Do nothing

Option one is to do nothing.

And I’ll be honest with you – while I firmly believe I’ve outlined some practical suggestions in this report, they do require commitment and investment to execute.

So if you’re ticking along nicely and don’t desire to grow substantially, it’s probably better to do nothing than to skirt round the edges.

Option 2: Do it yourself

Option two is to do it yourself.

In some industries I’d say, “if you’re a little low on funds but have plenty of time on your hands and have the interest, then sure, give it a go”.

But financial services isn’t one of those industries.

This is technical and complex stuff, and you’re competing against some of the sharpest organisations in the country.

So unless you want a wholesale career change from fin services to digital marketing, my recommendation is to steer clear of this one.

Option 3: Hire Internally

Option 3 is to hire internally. This will free up your time, although internal people need to be found, on- boarded, trained and managed.

With internal hiring, the sticking point is that the strategies covered in this Guide encompass a broad range of skill sets and disciplines: marketing strategy, in-depth data analysis, copywriting, conversion- oriented design, technical integration, conversion optimisation and so on.

And it’s pretty much impossible for any one human being to be exceptional at all these skill sets.

So doing it in-house may involve employing not one but several specialists, which can start to get expensive…. if you can find them in the first place.

Nevertheless, if you have sufficient resources, this is certainly an option.

Option 4: Hire an agency

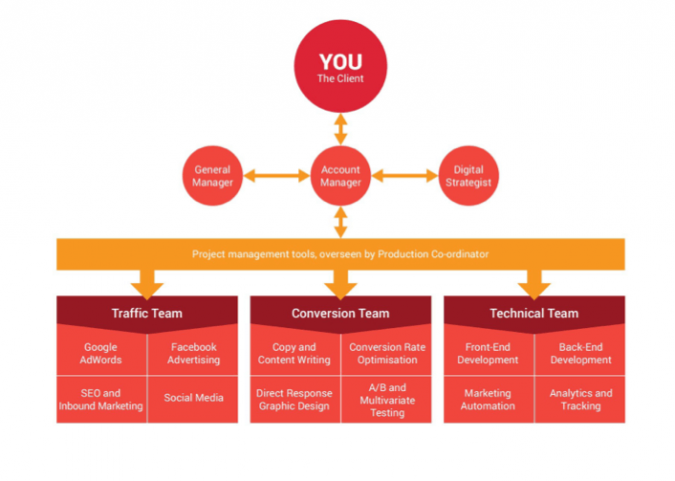

Option four is to hire an agency such as Marketing Results to take care of these strategies for you.

Every agency model is different, but in the case of Marketing Results, we give you access to an “Expert Team” of up to 12 individual specialists working on your traffic, conversion and automation Campaigns… often for much less than the cost of hiring one full time resource in house.

And as a result, you generate a steady stream of inbound leads to power your business growth.

All the critical components of your digital marketing are taken care of, your time is freed up to work “on”

the business and not “in” the business, and what you know should be getting done, actually gets done.

This option won’t be right for everyone, nor do we accept a new client unless we really feel there is a genuine fit with what we do and that we can add value.

What’s the next step?

If you’re curious to explore further, then the next step is to set up a time to conduct a complimentary Online Marketing Strategy Session, normally via phone in the first instance.

During that initial chat, we’ll evaluate your current online marketing strategy and work with you collaboratively to create an immediate plan to increase your leads and sales online.

If you enjoy the conversation and get value from it, we can discuss working together.

On the other hand, if what we come up with doesn’t align with what you need, or for any reason we feel we’re not the best team to assist in your situation, then there’s no harm done – at least we explored the possibilities.

To take the next step, call us on 1300 RESULTS (1300 737 858) within Australia or +61 7 3161 1541 internationally.

Or, complete the Strategy Session application here.

And whatever you do, I hope you’ll apply some of the strategies in this Guide to further your business and drive more leads and sales with lower marketing costs.