For a growing number of mortgage brokers, Facebook advertising is becoming a more critical piece of the lead generation mix.

And it is certainly true that some mortgage broking firms are getting outstanding lead generation results with Facebook ads.

There are are also many firms who have tried and failed.

In this article I want to share with you a specific mortgage broker Facebook lead generation case study that resulted in 131 new client appointments booked over a 6 month period.

Background

Trilogy Funding is one of Australia’s premier mortgage brokers specialising in serving the needs of property investors. They’re also one of our longest-standing clients. We first started working together in 2005!

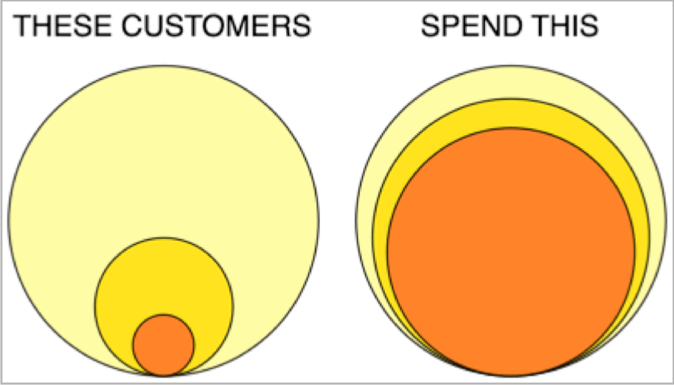

Within their target market of “property investors”, Trilogy further identified sophisticated property investors with at least 3 properties / $1.5M in loans as a sweet spot that they know how to serve very well.

In other words, they have a clear and compelling value proposition:.

They recognise that a relatively small slice of the entire market are worth the most to their firm – so that’s where they focus.

The first step is to be clear on WHO you want to target…

But it’s another thing entirely to strategise HOW you’re going to target them.

That’s where Facebook advertising comes in…

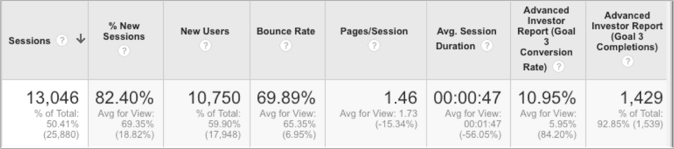

Key Facebook Advertising Results

Trilogy’s Ideal Client can potentially represent very high value, but they don’t grow on trees. That’s what makes these results even more impressive.

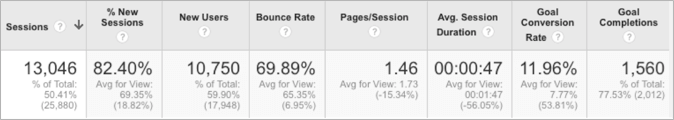

Over a period of 6 months the client was able to achieve the following with FB advertising:

- Spend $17,358

- New Email Subscribers: 1,429

- Cost Per Subscriber $12.15

- PLUS New Enquiries (e.g. Consultation Requests) 131

- Cost Per Consultation $132.50

TOTAL Goal Completions (Conversions) From Facebook Ads: 1560

New Subscribers From Facebook Ads: 1429

Step-By-Step Instructions

Facebook Advertising success comes down to much more than just the ads and the targeting themselves.

There is a whole series of elements that must be aligned in order to achieve the best results.

Let’s unpack what some of these elements are:

Success Factor #1: A Defined Target Customer

The more specific the targeting, the more likely you are able to laser in on a buying “hot button” with your Ideal Prospect.

Your audience has to be big enough to be impactful, but small enough to be relevant to what you have to offer.

In the case of Trilogy Funding, some of the elements of their Ideal Customer Persona were:

- Existing property investors

- Multiple property owners (3+)

- $1.5M+ in borrowings

- Interested in better investing strategies

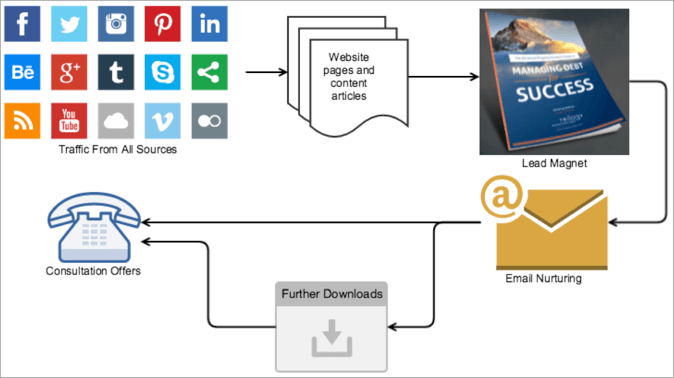

Success Factor #2: The Right Offer(s) and Funnel

Here’s a success secret of Facebook Advertising: nothing really happens until you get the prospect OFF Facebook and ON to your email list.

Facebook is a great attraction medium, but it’s typically not a great conversion medium without further assistance from your marketing funnel.

Here’s a (highly-simplified) diagram of how the Trilogy Funding funnel is constructed, with the aid of landing pages and marketing automation.

- Traffic reaches the website and their offers via a variety of sources (including Facebook ads)

- Traffic that hits the website but doesn’t convert is then retargeted on Facebook (as one of many targeting methods)

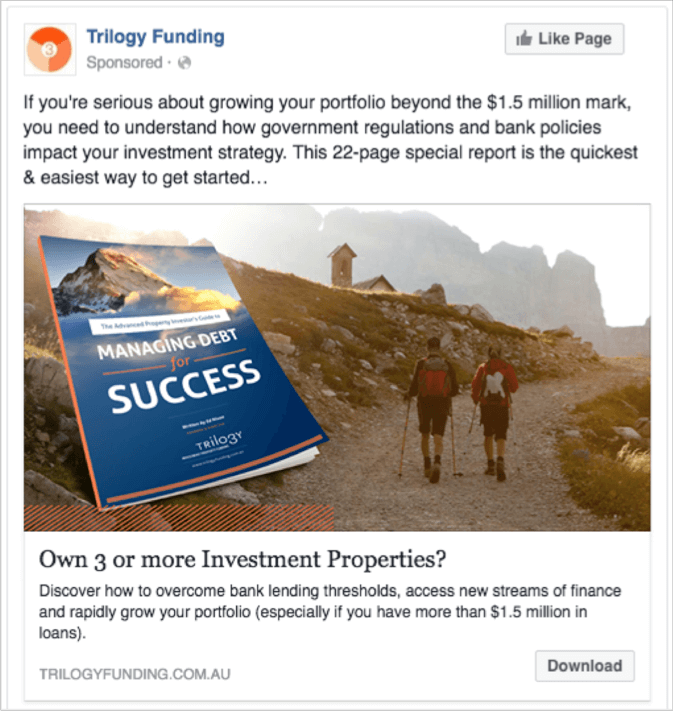

- Traffic is driven toward the primary lead magnet, titled “The Advanced Property Investor’s Guide To Managing Debt For Success”. (Note how the lead magnet calls out directly to the specific target market with an irresistible problem-solving statement).

- Email nurturing kicks in, aimed at enlarging on the core proposition of the lead magnet and suggesting one of several “Next Step offers” and further downloads.

- Next step offers include print booklets and a variety of other premium content pieces.

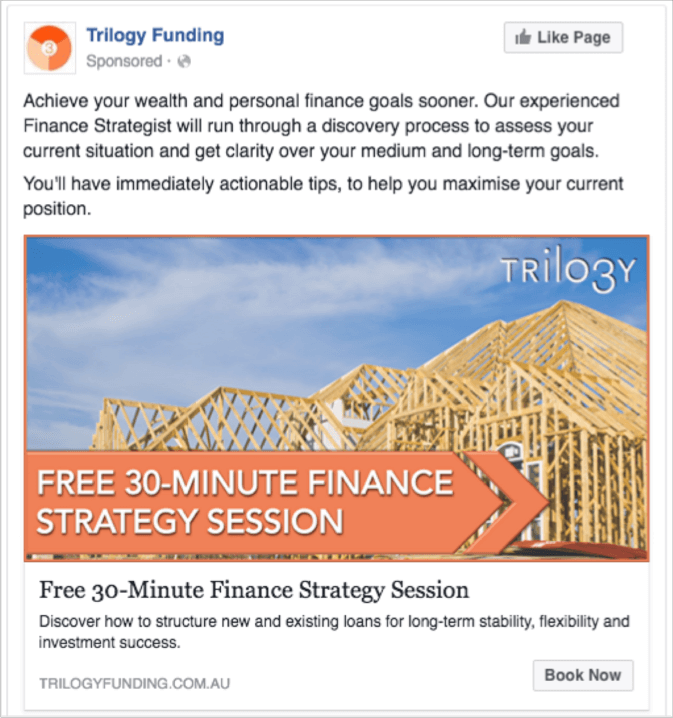

- The ultimate goal is to promote a Consultation Offer which connects the advanced property investor up with a Trilogy Funding broker.

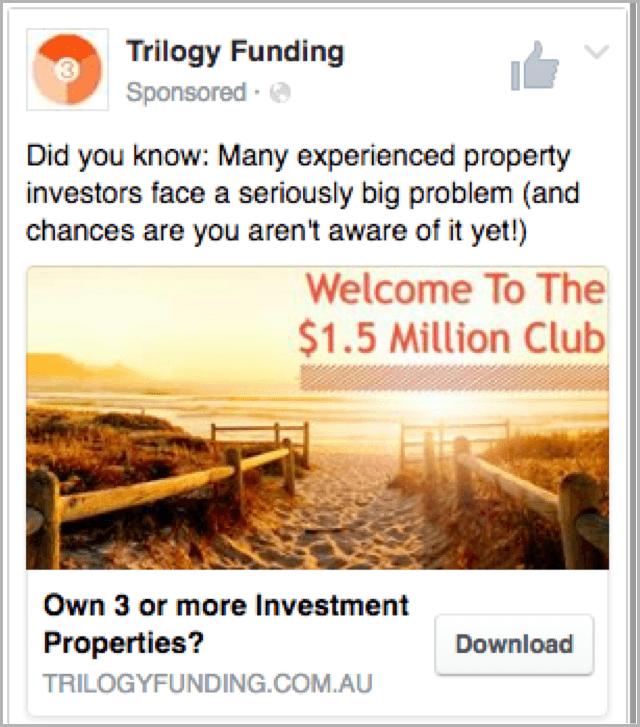

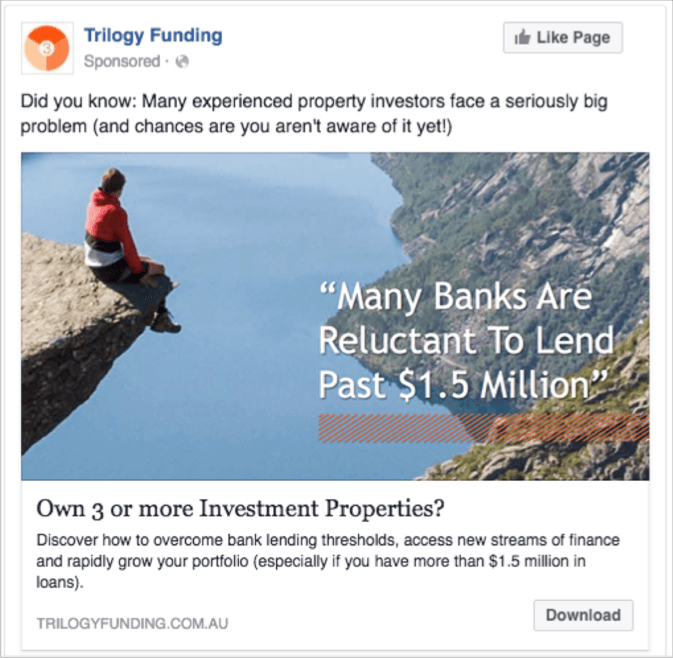

Success Factor #3: Strong Direct-Response Ad Copy

Now with the right funnel in mind, it’s time to create ads – lots of them!

Here are a few examples of some of the ads in play, showing a variety of copy elements, images and offers:

Example #1: Mortgage Broker Facebook Ad Example

Example #2: Mortgage Broker Facebook Advertising Example

Example #3

Example #4: Mortgage Broker Facebook Remarketing Ad

Success Factor #4: Systematic Ad Testing

So the ads are in place. Now it’s time to test!

At the time of writing there were 1,058 Facebook ads operating across 13 campaigns.

That’s because Facebook ads can produce markedly different conversion results based on a number of factors:

- Targeting (of course!)

- Image selection

- Copy

- Device – mobile vs desktop (mobile is BIG)

- Action buttons

- Lifecycle factors (is it the first ad the prospect has seen, or the 5th ad in a series?)

- And more

Strategy can go part of the way, ensuring that the right messages are matched with the right targeting.

But beyond strategy, it comes down to a combination of creativity and deep knowledge of what has worked well in the past in similar situations. If you need inspiration, this swipe file of 35 Top Facebook ads will help.

Success Factor #5: The Right Targeting

The right targeting on Facebook ads is critical – and Facebook offers some of the most interesting and impactful targeting methods around.

Here we tested a range of targeting methods, including:

- Retargeting website visitors via all traffic sources

- Existing Facebook fans and friends-of-fans

- Lookalike audiences based on a Custom Audience “seeded” by the client’s existing email list

- Topic targeting – e.g. people interested in Real Estate / Wealth / Investing

Usually, one or two audiences will begin to out-perform the others, allowing the focus to go where the results are best.

Success Factor #6: Re-Calibration and Expansion

Facebook Advertising is effective, but audiences and ads can “fatigue” within a matter of days or weeks, which means re-calibration is necessary to keep results rolling in.

Some techniques here include:

- Regularly changing up copy and creative

- “Resting” successful creative for several weeks before re-activating

- Shifting successful audiences to related or “shoulder” audiences

- Expanding what’s working with lookalikes

- Testing new landing pages

- Bid management to maximise clicks within a given budget

- Pausing advertising for a time and focusing on funnel nurturing

It’s a never-ending process:

Step 1 is to get a campaign up and running that works.

Step 2 is to test, measure and optimise that campaign to keep it going and growing in the face of ever-stiffer competition on Facebook.

Next Steps

Trilogy Funding’s success is one of many examples we could share.

While some industries work better than others on Facebook, we’ve found that almost any industry can achieve a solid Return On Investment.

But as you can see, there are quite a few pieces of the puzzle you need to have in place in order for this to work.

So after reading this article, you might be in one of three situations:

- Despite the success others are having on Facebook, you hate money and don’t want to try anything new. ?

- You’ve never tried Facebook advertising, but are interested to get started the right way.

- You have existing Facebook ad campaigns that you believe can perform better with the right strategy and management.

If you’re sitting in camp #1, sorry, can’t help you there…

But if you’re in either of camps #2 or #3, the next step is to have a chat about your campaign objectives and goals.

Then based on where you are now and where you want to be, we’ll devise a strategy to get you there.

If you like our strategy, we can talk about us managing the whole process for you.

But regardless of what you decide, you’re free to take the strategy we develop and implement it any way you want – or not at all.

To arrange this initial chat, please contact us now.

Facebook advertising is great, but it’s only getting more competitive. To get the upper hand, contact us now.